Selling a plot or villa is a significant financial decision that requires careful planning and consideration. It's not just about setting the right price or preparing the property—it's also about choosing the right buyer. The wrong buyer can lead to complications, delays, or even a failed transaction. Understanding how to avoid potential issues before they arise is crucial for ensuring a smooth and successful sale.

In this blog, we’ll explore the red flags you should watch for when selecting buyers for your plot or villa. From verifying financial stability to recognizing pressure tactics, we’ll provide valuable insights to help you avoid common pitfalls. By the end, you’ll know how to choose the right buyer and protect yourself from scams or problematic transactions.

Know the Importance of Selecting the Right Buyer

The right buyer not only guarantees that the transaction goes smoothly but also ensures that the sale is financially secure. A buyer who can afford your property and is willing to follow the legal and financial process will save you from potential headaches. On the other hand, an unreliable buyer can waste your time, put your property at risk, or even cause the deal to fall through.

Selecting a trustworthy buyer helps you avoid unnecessary complications, safeguard your financial interests, and close the deal without unnecessary stress.

Common Red Flags to Watch Out for

When selling property, it’s important to stay vigilant for potential warning signs. Here are some of the most common red flags in property transactions that you should be aware of:

-

Lack of Proper Documentation: Any buyer who is unwilling or unable to provide proper documentation should raise a red flag. Before proceeding, ensure the buyer has valid identification, proof of address, and necessary financial documents, such as bank statements or a mortgage pre-approval letter.

-

Unclear Source of Funds: One of the biggest concerns when selling a property is whether the buyer has the financial capacity to complete the transaction. Always ask for proof of funds to ensure that the buyer’s financial situation aligns with the price of the property. A buyer who is reluctant to provide this information may be trying to cover up financial issues.

-

Rushing the Process: Genuine buyers understand that buying property takes time. If a buyer is pressuring you to close the deal quickly or seems overly eager to skip due diligence, it could be a warning sign. Buyers should be patient and willing to allow sufficient time for inspections and paperwork.

-

Unrealistic Offers: If a buyer offers an amount significantly higher than the market value, it’s essential to be cautious. While it may seem appealing at first, such offers could be part of a scam or a tactic to lure you into a deal. Always do your due diligence to ensure the offer is realistic and based on the actual value of your property.

How to Verify a Buyer’s Credibility

To ensure that you're dealing with a legitimate buyer, here are some steps to follow:

-

Check References and Reviews: Speak with previous sellers or agents who have worked with the buyer to get an idea of their reputation. Online reviews and references can also provide insight into their track record and reliability.

-

Conduct Financial Checks: A serious buyer should have no problem providing financial proof. Consider asking for a credit report or evidence of pre-approved financing. This helps to confirm that the buyer can follow through on their offer.

-

Ensure Legal Compliance: Verifying that the buyer is legally allowed to purchase the property is a critical step. For example, check if they have any legal disputes, and make sure that they are acting in good faith.

Warning Signs of Potential Scams

Some buyers may attempt to scam sellers by employing certain tactics. Recognizing these behaviors can help you avoid falling victim to fraud.

-

Pressure Tactics: A legitimate buyer will be patient and allow time for due diligence. If a buyer is pushing you to close the deal fast or seems overly aggressive, it’s important to take a step back and reconsider the transaction.

-

Unusual Payment Methods: Watch out for buyers who insist on using non-traditional or suspicious payment methods, such as cash payments or wire transfers from unknown sources. These methods are often used to cover up fraudulent activity.

-

Inconsistent Communication: Communication is key in any transaction. If the buyer is hard to reach, unclear about their intentions, or unwilling to engage in transparent conversations, it could be a sign that something isn’t right.

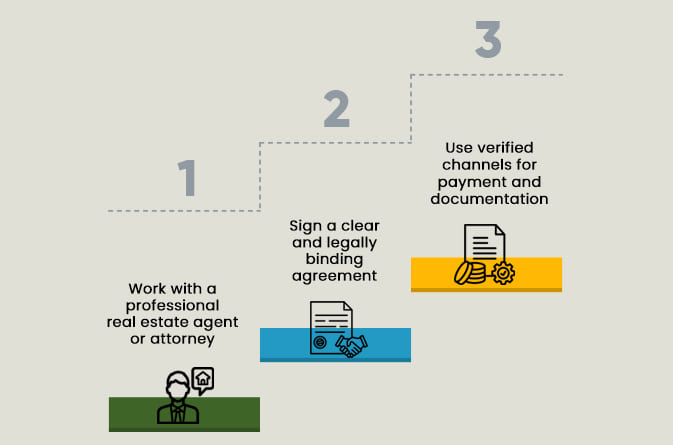

Steps to Protect Yourself During the Transaction

To ensure a safe and successful sale, consider these steps:

- Work with a professional real estate agent or attorney: They can help you navigate the complexities of the transaction and ensure everything is handled correctly.

- Sign a clear and legally binding agreement: This will protect both parties and ensure the terms are clear and enforceable.

- Use verified channels for payment and documentation: Always use secure and recognized methods for financial transactions and exchanging documents.

Final Words

Choosing the right buyer is critical to ensuring a smooth and secure sale of your plot or villa. By keeping an eye out for common red flags and taking the necessary precautions, you can avoid potential risks and scams. If you’re unsure about the buyer’s credibility, don’t hesitate to consult with professionals who can guide you through the process.

Remember, a little caution today can save you from major problems down the line. If you’re ready to sell your property, make sure you carefully assess your buyer to ensure a successful transaction.